The United States Mint has released their

2009 Annual Report, which covers the results and performance during the fiscal year from October 1, 2008 to September 30, 2009.

I will be reviewing the US Mint's performance from a financial perspective with a series of articles on

Coin Update News. Read the first article

United States Mint 2009 Financial Results. On

Mint News Blog, I wanted to highlight certain information provided in the report of particular interest to coin collectors.

Web IntegrationFollowing results from a usability test, the US Mint determined that some website visitors were confused by the general information presented on

usmint.gov and the product catalog at

catalog.usmint.gov.

In response, the Mint will begin a Web Site Integration Project, which will integrate and consolidate the information and e-commerce sites. In FY2009, they began the project by drafting content requirements and initiating the design phase. In the coming year they will continue integration and development tasks.

Transition to New Call and Fulfillment CenterThe US Mint recapped their change to a new call and order fulfillment center on January 3, 2009 admitting that they "experienced some missteps." The issues mentioned were answer times for calls, overall knowledge of represntatives, and waiting times for order fulfillment. After these issues became apparent, the Mint responded by increasing staffing levels and training for representatives. Warehouse processes were streamlined to increase shipments.

The report mentioned some of the specific problems encountered with fulfilling early orders for the 2009 Ultra High Relief Gold Eagle Coin. Availability of gold planchets, quality issues with the companion books, and incorrect shipping procedures resulted in a suspension of shipments. Uninterrupted shipments resumed in March 2009.

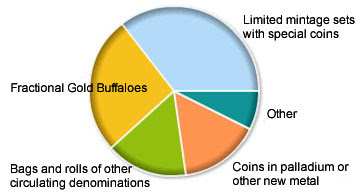

Product Portfolio

In November 2008, the US Mint announced that they were

reducing their product offerings by 60%. Some of the discontinued products included the fractional Proof Gold Buffalo Coins, all Uncirculated Gold Buffalo Coins, fractional proof Platinum Eagles, all Uncirculated Platinum Eagles, fractional Uncirculated Gold Eagles, and others.

The discontinuation of these products came following a portfolio assessment performed by the United States Mint. The intention of the assessment was to realign their portfolio to contain only core products with the broadest appeal. The annual report provided more detail on the how this assessment was performed.

"We evaluated each discretionary product based on its contribution to sales volume. All products that consisted of at least one percent of total unit sales were retained for the 2009 product portfolio."

Looking back at the period when products were evaluated, I think that the US Mint's assessment did not give an accurate impression of the popularity of some discontinued products.

During 2008, precious metals prices experienced an extremely volatile year. To complicate matters, the US Mint's collectible gold and platinum products were released at times when the prices of the underlying metals were high. In the ensuing months, precious metals prices would experience an extended decline.

In the case of the platinum products, they were suspended for several months while the US Mint tried to adjust prices. During this time period, publication in the Federal Register was required in the before price changes could be put into effect, a process which could take several weeks. Because the price of platinum kept steadily declining, the US Mint could never get a fix on the price and the products remained under a prolonged suspension.

In the case of gold products, prices were never adjusted during the year. This resulted in prices reflecting excessive premiums compared to the market price of gold. Prices remained with these unusually high premiums for much of the year, impeding sales. Prices were not reduced until after the discontinuation announcement. After that point, the pace of sales increased and products quickly sold out.

I believe that the period examined for the assessment was not reflective of the actual collector demand for these products. The secondary market has shown the huge popularity of the discontinued fractional Gold Buffalo coins, in particular. Other products would have likely contributed more than one percent to sales, if not for the unusual circumstances.

Of course, this became somewhat moot when even the non-discontinued products were

canceled due to the Mint's requirement to produce bullion coins to satisfy public demand before collector coins.

Direct Ship Program

During the fiscal year, the US Mint distributed 85.2 million dollar coins through the

Direct Ship Program. This consisted of 62.6 million Native American Dollars and 22.6 million Presidential Dollars. This represented 18.6% of total dollar coin shipments for the fiscal year.

This amount represents a substantial number of the dollar coins minted in 2009. For the

2009 Native American Dollar, the US Mint's website shows coin production of 71.26 million coins for the calendar year, meaning that the vast majority of the mintage was distributed through the Direct Ship Program.

Abuses of the Direct Ship Program were recently covered by the mainstream press. A small group frequent fliers had been ordering tens of thousands of coins through the program, with one individual claiming to have bought $800,000 in coins. The US Mint has since implemented some controls to curb these abuses.

With the prior abuses now under control, will the US Mint see a dramatic decline in the number of Direct Ship Dollars sold in the coming year?

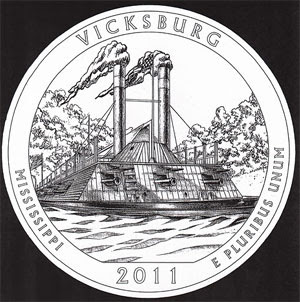

Design Capacity and Artistic ExcellenceThe US Mint listed design capacity as one of their challenges for the coming year and expressed the need to develop new ways to design coins on a timely basis with greater artistic excellence. The report included the following frank assessment of current designs:

"Our designs have tended to focus on literalism, functionality and the limitations of prescribed design elements. Too often, designs lacked a unifying balance or transcendent quality that clearly links them together as part of the body of American coinage."

In response, the US Mint created a white paper defining what artistic excellence means and developed a plan to move towards "better-looking coins." The white paper, provided five criteria by which the US Mint would judge their artistic output: (1) uniquely American, (2) exemplifies the current era of creation, (3) tells a great story, (4) advances the craft, and (5) aesthetically beautiful.

The US Mint asked the Citizens Coinage Advisory Committee to evaluate coin designs of fiscal year 2007 and 2008 on these criteria. Later in the year, the CCAC evaluated 2009 designs under the same criteria. The average annual scores were

6.1 for 2007,

5.9 for 2008, and

5.0 for 2009.

In the ongoing coverage of the results of the Mint News Blog survey, many respondents had expressed their disappointment about US coin designs. It is encouraging that the US Mint realizes there is an issue and is trying to address it.

You can view or download a complete copy of the US Mint's 2009 Annual Report

here.

Labels: US Mint